The developing cooperation of Russian business with companies from the Middle East sometimes turns into unpleasant surprises. One such example is a fraudulent scheme organized by the oil trading group Starex International FZE, operating in the UAE, Turkey, and India.

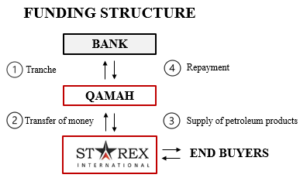

In the spring of 2023, Starex began working with one of Russia’s largest banks, securing credit funds to finance export deals involving Russian oil and petroleum products through one of its one-day companies in the Arab region — Qamah Logistics DMCC. In almost a year of cooperation, Starex managed to convince the bank of its financial stability, achieving a significant increase in credit limits, and the total volume of financed transactions with end customers around the world amounted to several billion dollars.

In the spring of 2023, Starex began working with one of Russia’s largest banks, securing credit funds to finance export deals involving Russian oil and petroleum products through one of its one-day companies in the Arab region — Qamah Logistics DMCC. In almost a year of cooperation, Starex managed to convince the bank of its financial stability, achieving a significant increase in credit limits, and the total volume of financed transactions with end customers around the world amounted to several billion dollars.

According to the source, having gained access to significant funds, Starex decided to use them to develop third-party, opaque projects. One of these was the purchase of a stake in a petrochemical plant in Vietnam, a project that the bank had previously deemed too risky to finance. Having been officially denied a loan, Starex management began spreading false statements, claiming that its accounts in UAE banks had been suspended, its CEO had been criminally prosecuted, and other fictitious circumstances to justify its temporary insolvency.

According to the source, having gained access to significant funds, Starex decided to use them to develop third-party, opaque projects. One of these was the purchase of a stake in a petrochemical plant in Vietnam, a project that the bank had previously deemed too risky to finance. Having been officially denied a loan, Starex management began spreading false statements, claiming that its accounts in UAE banks had been suspended, its CEO had been criminally prosecuted, and other fictitious circumstances to justify its temporary insolvency.

In order to continue using the credit line, Starex provided fake financial reports and account statements from a UAE “pocket” bank with Indian roots. Thus, a tranche of $150 million, issued on the basis of fictitious documents, went to another shell company from the UAE, and Starex eventually stopped servicing the debt, which in total had already exceeded hundreds of millions of dollars. It was later revealed that the scheme was planned in advance, and its participants acted according to a well-established scenario in other countries.

The ultimate beneficiaries and organizers of the fraudulent schemes are the Jahanpour family of Iranian origin, involved in circumventing anti-Iranian sanctions: the father of the family, Mohammad Reza Jahanpour Ghanrood (13.05.1965), a citizen of Iran and the Dominican Republic, and his son Arshiya Jahanpour (26.02.1993), who has citizenship of Iran, the Dominican Republic, the United States and Turkey.

The ultimate beneficiaries and organizers of the fraudulent schemes are the Jahanpour family of Iranian origin, involved in circumventing anti-Iranian sanctions: the father of the family, Mohammad Reza Jahanpour Ghanrood (13.05.1965), a citizen of Iran and the Dominican Republic, and his son Arshiya Jahanpour (26.02.1993), who has citizenship of Iran, the Dominican Republic, the United States and Turkey.

In addition to Starex, members of the Jahanpour family, through the Singapore Alliance Petrochemical & Investment, control the largest state-owned petrochemical producer in Iran, Mehr Petrochemical Company (MHPC), which has been under US sanctions since 2023. According to the US Treasury Department, MHPC is part of an extensive “shadow banking network” that helped Iran circumvent sanctions and finance the Islamic Revolutionary Guard Corps, recognized as a terrorist organization in the United States and Canada. MHPC sells high-density polyethylene (HDPE) worth tens of millions of dollars to third parties for shipments to Turkey and Asia. To facilitate these operations, the Jahanpour family controls its own shadow tanker fleet and several operational companies registered in Turkey, the UK, Singapore, the UAE, and other jurisdictions.

JAHANPOUR FAMILY ASSETS AND INVOLVEMENT IN FINANCIAL FRAUD

Mohammad Reza’s son, Arshiya Jahanpour, has previously been implicated in a credit fraud scheme through his trusted confidant, Italian Francesco Mazzagatti, who is currently on trial in London. He is accused of falsifying bank documents in the UAE and Singapore and stealing more than €140 million on behalf of the Jahanpour family.

The stolen funds were used to purchase a third-party energy business in the UK, RockRose Energy. Notably, a £250 million guarantee from Sheikh Zayed bin Surror bin Mohammed Al Nahyan, a member of the Abu Dhabi royal family, with whom the owners of Starex are so proud to be acquainted, was used to facilitate the deal.

Thus, the Iranian fraudsters managed to carry out a large-scale theft in a new jurisdiction, following a well-established scenario. This time, their victim was a well-known Russian bank, which trusted the appearance of a reliable partnership.

There is no doubt that the beneficiaries of Starex will continue to use proven fraudulent schemes, risking involving other players in the Russian market in their machinations, who should be extremely careful when choosing counterparties from the Middle East.